How To Guides

Opening and account and becoming a member of Enniskillen Credit Union is Simple.

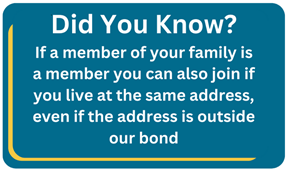

Firstly, Each Credit Union has what’s called a “common bond”, For most Credit Unions, this the area where members live or where they work- potential members will need to live or work within this bond to be eligible to join. This is known as a community-based Credit Union.

Enniskillen Credit Unions Common bond is to Live or Work in the Enniskillen or Kinawley Areas if you are unsure if you home or work address falls under this bond you can enter your postcode or address into our bond area checker.

If your address is within the red areas, you are eligible to join.

If you address is just outside the area please get in touch as you may still be able to Join.

If you are unable to join us the map also points out other Credit Unions in Fermanagh, contact your nearest as you may be able to join them.

If you are within our bond then you are one step closer to joining, First you will need to complete an application form, this form will capture some basic information to allow us to being opening your account when you visit our office.

Information requested will be: Name, Date of birth, Address, Occupation/place of employment and Contact Details,

Application forms can be picked up in either of our offices or downloaded here:

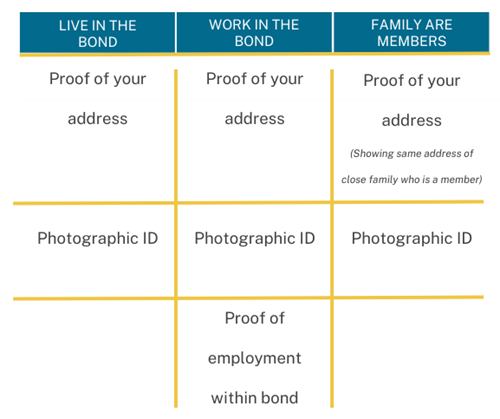

Next, we will need you to provide some documents, what you need to provide will depend on how you are eligible for membership. The table below shows what you need and when.

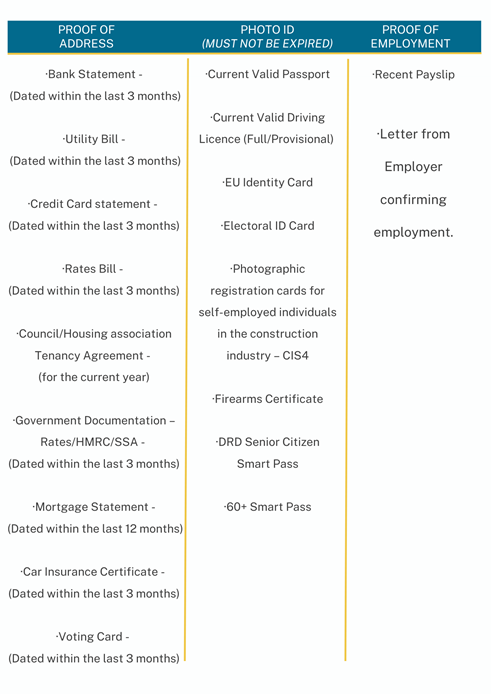

The Next table shows What documents we can accept

Now that you have your application complete and your documents ready you’re all set to become a member of your local Credit Union simply call into either of our offices with your form and Documents and we will have your account opened in a few minutes.

Once your account is open you will need to pay in a minimum balance of £2.00 and pay a £1.00 membership fee*. (*This in a one-off joining fee)

We will then issue you with a member passbook which will show your membership number and your account number / sort code. The passbook is also a handy place to keep your transaction receipts.

And that’s it, you are all set up as a member of Enniskillen Credit Union, have a look at all our other How to guide to make sure you know how to access and use all our services, and if you ever need to get in touch our contact details can be found here:

We are sorry to see you want to close your account but don’t worry it’s easy to do.

Just before you go, please have a look at the services you could be missing out on.

Still need to close your account?

No problem, simply call into the office with your ID and we can withdraw your account balance (In Cash, Cheque or Bank transfer) and close your account.

Cant come in or closing account because you have moved?

Get in touch with us and we can work out the easiest way to get the account closed for you. You find our contact details here:

Joining a new Credit Union?

Let your new Credit Union know you have an account with us, and the two Credit Unions can handle transferring your account for you.

Thinking of joining our Credit Union or not sure what you can do with your account? This guide will show you some of the benefits of a membership with Enniskillen Credit Union.

Savings

With our Credit Union you can save up to £15,000 (£10,000 for minor accounts), not only are these savings secure they help all other members in our local community. A Credit Unions ethos is to provide a mechanism in our community for mutual self-help. This allows those who have the capability to and are in a position to save to increase our fund pool to lend to members who maybe unable to get credit elsewhere

Not only are your savings helping other members in our community but they are can also gain a return. Every year (subject to availability) the Credit Union pays back its surplus Income to its members in the form Dividends on Savings and Rebates on Loans. More information about Dividends and rebates can be found here

Dividend and Rebates

A Credit Union at its heart is a non-profit organisation, what that means for our members is that all the money we make on loans or from our investments goes towards paying for our operational expenses and improvements to our member facilities. The remaining amount (if available) is called our surplus. Some of this surplus will go into our legally required reserves but the rest will be given back to members in the form of a Dividend on their shares or a rebate on the interest they’ve paid on a loan over the last year.

The rates of Dividend and Rebates are calculated following our financial year end on the 30th of September and are declared to our members following our annual audit at our AGM in December. (That means you can get some extra funds just in time for Christmas)

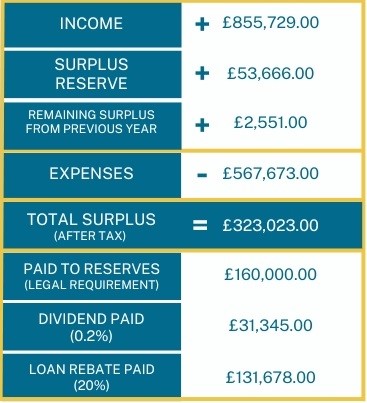

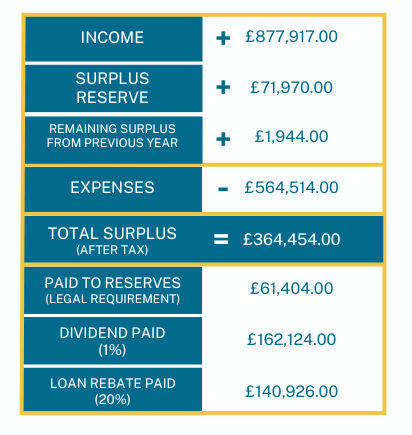

The Tables below show how these funds were used for the financial years ending 30th September 2022 & 30th September 2023.

2022

2023

For our Junior accounts (Up to age 16) the Dividend is based solely on investment income received.

For the Year ending 30th September 2022 we were able to pay 0.65% which equated to £8,116.00 paid to minor accounts.

For the Year ending 30th September 2023 we were able to pay 3% which equated to £39,970.00 paid to minor accounts.

These rates are dependent on how the Credit Union performs in the year so they can go up or down. Our annual accounts can show how the surplus is split for the current year.

The credit union provides Life savings, Loan protection and Death benefit insurance to eligible members at no direct cost.

Members are eligible for these insurances so long as they open their account before their 70th birthday and are in good health when joining. Benefits will remain in place as loan as the account stays open. However, the Life savings portion is affected by account balance.

The sections below will provide more information on the 3 elements of our member protections.

Life Savings (LS)

Life savings insurance is the life insurance your credit union takes out for all eligible members as an additional incentive to save regularly and maintain savings with the credit union.

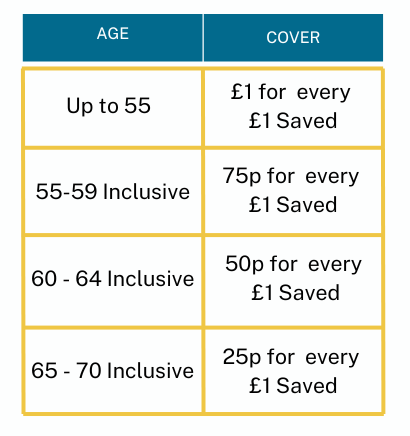

The amount of insurance benefit on savings which a member is entitled to is in direct proportion to their savings and their age up to a maximum payment of £6000*

*(Maximum payment limit is set depending on cover level of the credit union which may change during the lifetime of your membership)

No further insurance is gained following a member’s 70th birthday.

Once earned the insurance remains in force as long as you leave your savings in your account. Share withdrawals will affect insurance cover as the payment is calculated on the lowest balance from the age brackets to death.

Where an eligible member dies before their 55th birthday the insurance payment will be equal to the share balance at the date of death.

Where an eligible members death has been deemed accidental (official confirmation required) the Life savings (LS) and Death Benefit (DBI) Payments will double.

Loan Protection (LP)

When borrowing from the credit union an eligible member’s loan is insured in the event of death. This means that should an eligible member with an outstanding loan die the remaining loan balance will be paid in full* meaning you can have the confidence that your dependants will not be obliged to repay the outstanding balance in event of your death.

*(subject to terms and conditions and cover limits)

Eligibility for loan protection is as follows.

- The borrower has not reached their 80th birthday (or will not reach their 80th birthday before the loan term ends)

- The borrower can confirm that they can actively and regularly perform all the usual duties of their occupation.

- The Borrower can confirm that they in good health.

Further information may be required depending on the members age and the total value of the loan. Some applications may require insurance approval from underwriters before the loan can be approved by the credit union.

Death Benefit Insurance (DBI)

All eligible members are covered for a £1000.00 Death Benefit Insurance in the event of death payable to the funeral undertaker towards the funeral bill.

It’s now even easier to manage your credit union account with our online banking and mobile app.

Visit your local credit union from the comfort of your home or on the go.

Online banking Features

- Transfer savings to any UK bank account on the same day (same day cut off at 16:00. Transfers after this time will be processed the following morning)

- View balances

- Generate statements.

- Apply for loans.

- Transfer between your own CU accounts

Register today

Once registered download the app from Google Play or App Store

The Credit In Credit Union

Loans with Enniskillen Credit Union are financed by the common pool of our members shares. So, by saving with a Credit Union, you are not only saving for your future but also allowing us to lend at fair and reasonable rates to our members. Many of whom can’t access credit elsewhere.

Enniskillen Credit Union currently offers 3 loan products:

Standard Loan - up to £14,999

- Apply for up to £14,999

- 12.68 % APR (Interest rate 11.94%)

- Maximum loan term 5 years

Large Loan - £15,000 - £50,000

- Apply for £15,000 up to £50,000 *

- 8.9 % APR (Interest rate 8.56%)

- Maximum loan term 10 years

*Restrictions apply based on insurable limits

Secured Loan - Up to value of savings

- Apply for up to value of savings.

- No application form required instant approval and in office collection (Secured loans cannot be processed online)

- 12.68 % APR (Interest rate 11.94%)

- Maximum loan term 10 years.

Further information on each loan product and terms and conditions can be found on our loans page.

There are 3 ways you can apply for a loan with us:

In Office

Simply call into our office at your convenience and complete an application form. A member of staff will be happy to assist you should you require it.

Staff will also be able to advise you if we would require any documentation to support your application.

Download Form

The loans page of our website provides an option to download an application form for you to complete at home.

Once complete you can drop it into our office or scan and email across to us.

You can download an application form from our loans page where you can also see what documentation may be required to support our application.

Alternatively you can download directly using the button below.

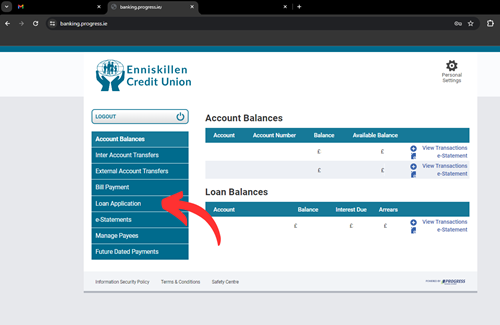

Online Banking

In our online banking service you can apply for a loan directly from your computer or your phone (Using our App).

Just select the loan application option from the memer area on our website or on the app as shown below.

Simply follow the on-screen instruction's to complete your application and our loans team will be in touch with a decision.

For all application methods a decision is made a maximum of 48 Hours from point at which all required documentation is received. Please check our loan terms and conditions to see what documentation is required for your application or alternately sepak to a member of staff.

Loan terms and conditions along with all other information on our loan products can be found on our loans page.

We currently have 2 interest rates for our loan products:

12.6% APR

For unsecured loans of up to £14,999 and loans secured by savings.

8.9% APR

For Loans from £15,000 to £50,000.

Both rates are applied to your loan on the reducing balance meaning that as your loan reduces so does the interest you pay at each repayment period (Weekly, Monthly or Fortnightly). This also means that if you are in a position to pay extra to clear your loan faster you will end up paying less interest.

Representative interest examples

The Tables below give an example of the interest paid at each monthly payment reduces over the term of the loan.

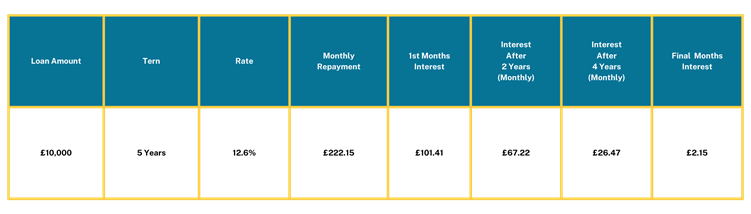

Eg1: £10,000 Loan over 5 Years Standard Loan Rate

This example shows that on a loan of £10,000 over a 5 year term with a monthly repayment of £222.15 the first interest payable on the first repayment is £101.41, meaning that £120.74 comes off the loan balance. The interest reduces with each repayment as it is charged on the remaining balance of the loan.

At the 2 year point the interest has reduced to £67.22 meaning £154.93 coming off the loan balance which is now approximately £6693.90

Again the interest is reducing with the loan balance to leave a final repayment at the 5 year point of £221.93 which is made up of £2.15 interest and final loan balance of £219.78.

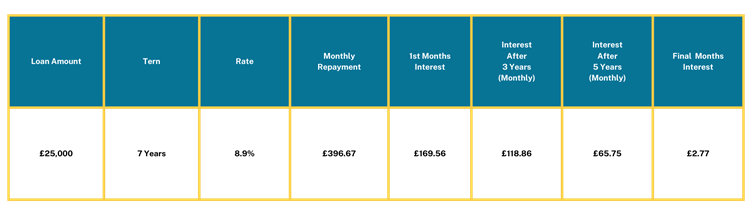

Eg2: £25,000 Loan over 7 Years Large Loan Rate

This example shows that on a loan of £25,000 over a 7 year term with a monthly repayment of £396.67 the first interest payable on the first repayment is £169.56, meaning that £227.11 comes off the loan balance. The interest reduces with each repayment as it is charged on the remaining balance of the loan.

At the 3 year point the interest has reduced to £118.86 meaning £277.81 coming off the loan balance which is now approximately £16,070.40

At the 5 year point the interest has reduced to £65.75 meaning £330.92 coming off the loan balance which is now approximately £8,713.21

Again the interest is reducing with the loan balance to leave a final repayment at the 7 year point of £383.78 which is made up of £2.77 interest and final loan balance of £381.01.

At any point you can request a loan amortisation schedule which will show the dates of your repayments, how much will go towards interest and off the loan balance as well as the expected remaining balance after the payment.

A Credit Union at its heart is a non-profit organisation, what that means for our members is that all the money we make on loans or from our investments goes towards paying for our operational expenses and improvements to our member facilities. The remaining amount (if available) is called our surplus. Some of this surplus will go into our legally required reserves with a portion of the remainder to be given back to members with loans in the form of a rebate on the interest they’ve paid on a loan over the last year.

For the last 2 years (ending 30th September 2022 & 2023 respectively) the loan interest rebate has been 20%. Meaning that one fifth of the interest you paid on your loan throughout the year (Oct - Sept) was paid back to your savings following our AGM in December.

More information on how our year end surplus is used, including dividends on savings can be found under the Dividend and rebate heading of the Member Benefit Section of this guide.

A credit union office in your pocket

We are here to help at the sadist of times

If something's not right we will fix it

Complaints Procedure

As a member owned and member run organisation, our members are at the heart of everything we do. Whilst we want to provide you with the best service possible, we recognise that sometimes things can go wrong and when they do; we want to know so that we can help sort them out as quickly as possible.

This page explains how you can help us deal with your complaint and what you can do if the problem hasn’t been resolved to your satisfaction.

How it works

If, for whatever reason, you are unhappy with any of our products or services please let us know in by email to our complaints officer at louise.mulrone@enniskillencu.com (please put “my complaint” in the subject box) or you can write to us at:

Complaints Department,

Enniskillen Credit Union,

27 Darling St,

Enniskillen,

BT74 7DP

Enniskillen Credit Union takes complaints very seriously and every complaint will be thoroughly investigated to identify the cause of the problem and resolve it fairly. Of course, it may be that the complaint is purely a misunderstanding that can be quickly cleared up, in which case we will act appropriately.

Once we have received your complaint, we will do everything that we can to resolve this for you as soon as possible. Where we are able to resolve your complaint within three business days, we will send you a letter confirming this which will inform you of your right to refer your complaint to the Financial Ombudsman Service if you are unhappy with the resolution provided. Where we are unable to resolve your complaint within three business days, we will send you a written acknowledgment of your complaint.

We recognise the importance of identifying how and why the issue occurred in the first place. Each complaint will be reviewed to identify the root cause as part of the investigation to ensure that, where required, redress is appropriate, and that we take relevant remedial action to ensure the same thing doesn’t happen again.

If you are unhappy with our response, you have the right to refer your complaint to the Financial Ombudsman Service, free of charge, but you must do so within six months of the date of our final response. If you do not refer your complaint in time, the Ombudsman will not have our permission to consider your complaint and so will only be able to do so in exceptional circumstances. Details of this service will be given to you within our final response.

It is important that you give us the opportunity of resolving the problem before referring it to the Financial Ombudsman Service. However you have the right to refer your complaint to the Financial Ombudsman Service before such time. The Financial Ombudsman Service will be able to assess your complaint if Enniskillen Credit Union agrees to this.

We hope to provide you with a full response as soon as possible; however, in some situations a more in depth investigation is required, so that we can fully investigate and respond to your concerns. However, we will keep you updated throughout this time, and where possible we will do our very best to respond to you more quickly.

The Financial Ombudsman Service

If after a period of eight weeks we have been unable to come to a satisfactory resolution and are therefore unable to issue you with a final response to your complaint, we will confirm this, together with the timescale in which you can expect a final response. At this stage, if you are dissatisfied with the delay you may refer your complaint to the Financial Ombudsman Service.

You can contact the Financial Ombudsman Service by either writing to them at the following address: Financial Ombudsman Service, Exchange Tower, London, E14 9SR. You can also contact them on the following number 0800 023 4567 or by visiting https://financial-ombudsman.org.uk

And finally...

We hope that you will never have the need to use this complaints procedure. However, if you do, please be assured that we will deal with your complaint as quickly and as fairly as possible

Manager / Complaints Officer

Louise Mulrone

Louise.mulrone@enniskillencu.com

Main Office

Enniskillen Credit Union

27 Darling St

Enniskillen

BT74 7DP

(028) 66323616

Financial Ombudsman

Still need help?

If these guides haven't helped with your query or if there is something else we can help with please get in touch.